Energy-efficient upgrades—like smart thermostats, solar panels, and better insulation—have become popular with homeowners who want to save money and cut down on their energy use. These improvements can also boost your comfort and increase your property’s value. What many don’t realize is these changes may have an impact on your home insurance policy, affecting everything from coverage requirements to premiums.

Understanding how your updates interact with your insurance can help you avoid surprises when it matters most. Knowing where your policy stands and what adjustments are needed keeps you protected. For homeowners thinking of investing in energy-saving improvements, it’s important to understand both the savings they bring and potential changes to your coverage.

What Qualifies as an Energy-Efficient Upgrade

Energy-efficient upgrades are becoming more common as homeowners look for smarter ways to save money and shrink their carbon footprint. These upgrades don’t just make a home more comfortable—they also offer a real opportunity to cut down on monthly utility costs. Knowing which changes qualify as energy-efficient upgrades matters because some improvements can even influence your insurance policy details.

Photo by Kindel Media

What Counts as an Energy-Efficient Upgrade?

Energy-efficient upgrades are any improvements or technologies that help your home use less energy while providing the same—or even better—comfort. These upgrades are popular with both new builds and older homes. Here are some of the most common examples found in today’s homes:

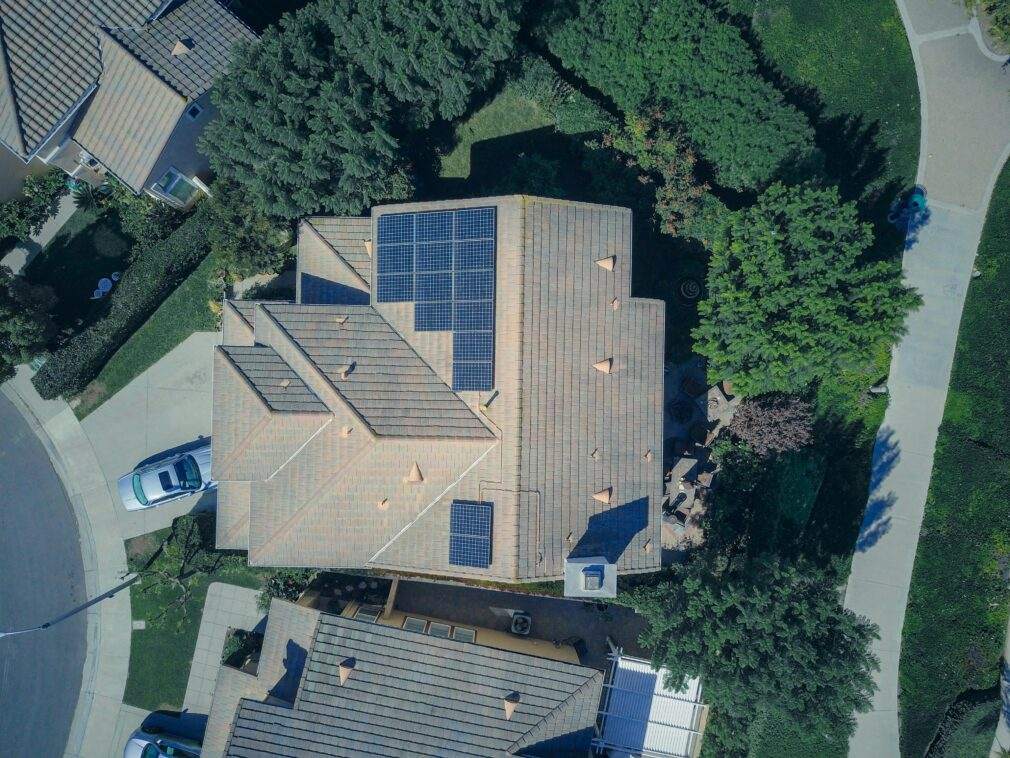

- Solar panels: Capture sunlight to generate electricity for home use, which means you rely less on the grid and can lower power bills.

- Insulation improvements: Upgrading wall or attic insulation keeps hot or cool air where you want it, which makes heating and cooling more efficient.

- Smart thermostats: These devices learn your habits and adjust the temperature automatically, keeping you comfortable and saving energy at the same time.

- Energy-efficient windows: Multi-pane and specially coated windows help regulate temperatures, reduce drafts, and improve your home’s overall insulation.

These upgrades are more than just buzzwords. They have quickly started to become mainstream as homeowners seek out long-term value and better daily living. For more examples and ideas, check out this guide on energy-efficient home improvements.

How These Upgrades Cut Utility Costs

Each of these upgrades has a direct impact on your monthly utility bill. The goal of energy efficiency is to do more with less—use less power for heating, cooling, and daily living without sacrificing comfort. Here’s how some of these upgrades work to save you money:

- Solar panels generate renewable power, letting you buy less electricity from your provider.

- Better insulation means you need less heating in winter and less air conditioning in summer.

- Smart thermostats prevent wasted energy by only adjusting the temperature when you need it.

- Efficient windows and weather sealing stop drafts, making your energy use steady year-round.

According to leading sources, simple changes like upgrading your windows or installing a smart thermostat can lower certain utility costs by 10-20% or more (7 Ways Energy-Efficient Home Upgrades Can Lower Your Utility Bills). These savings can add up every month, making the changes a wise investment for most homes.

Energy-efficient upgrades continue to gain popularity, and understanding what qualifies puts you in control—whether you want to lower bills, increase your home’s value, or see how your insurance policy could change. For more tips on protecting your investment, the team at Shielded Future offers regular updates on modern insurance strategies.

How Upgrades Can Change Home Insurance Coverage

Energy-efficient upgrades make a home more attractive, but they also reshape how insurance companies view your property. Simple improvements like solar panels or high-end insulation may seem like a win-win for comfort and savings, but your insurance policy might not automatically keep up. If you want your home’s new features fully protected, it’s important to know how upgrades touch your coverage—and your costs—before you make any final decisions.

Raising the Replacement Value of Your Home

When you upgrade, you’re not just making your space nicer—you’re often increasing what it would cost to replace your home after a fire, storm, or other covered disaster. Adding features such as energy-efficient windows, state-of-the-art appliances, or solar panels can hike up your home’s replacement cost. If your insurance company isn’t told about these changes, your coverage amount might not keep up. That could leave you paying out of pocket to replace expensive features that went untracked.

- Replacement value matters. Insurance policies base payouts on your home’s current features and materials.

- Upgrades can shift coverage needs. If you’ve invested in top-tier improvements, your coverage should match that investment.

- Don’t let coverage fall behind. If the insurance company doesn’t know what you’ve added, you might only receive enough money to rebuild the house as it was before the upgrades.

A good practice: After making energy-efficient changes, review your policy’s dwelling coverage and discuss any needed adjustments with your agent. This simple step prevents surprises when you need your insurance most.

Potential for Insurance Discounts

Upgrades aren’t always just about higher costs—they can sometimes help lower your insurance bill. Many energy-efficient changes make your home less risky in the eyes of your insurer. For example, stronger windows and improved insulation can mean less potential for water or wind damage. Solar panels with battery backups can reduce risks of power loss. Some companies even reward energy-saving technology with green home discounts.

Ways upgrades might qualify you for discounts include:

- Reduced risk from severe weather thanks to storm-resistant windows or roofs.

- Lower chance of fire loss with fire-resistant materials or upgraded electrical systems.

- Smart home devices that monitor and prevent damage, such as leak detectors or smart thermostats.

Insurers are increasingly offering incentives for these upgrades. For a deeper look at which improvements can affect premium rates, explore this detailed piece on energy-efficient upgrades and home insurance.

Insurer Requirements for Reporting Upgrades

Making your home safer or more efficient is a great move, but your insurer can’t read your mind. Most companies require you to report significant upgrades, especially those affecting the home’s value or risk profile. If you skip this step, you risk gaps in your coverage—or complications if you need to file a claim.

Insurers may request:

- Documentation of upgrades, such as receipts or permits.

- Photos or professional appraisals showing new features.

- Updated home value assessments to make sure your policy limit fits your upgraded property.

Reporting changes isn’t just a formality; it protects your investment. The right paperwork is your safeguard against possible disputes or uncovered losses after a claim. Wondering how to keep your insurance policy up to date? See this helpful resource on when to update your home insurance policy.

Photo by Mikhail Nilov

Photo by Mikhail Nilov

By staying on top of these requirements, you make sure your policy matches your home’s true value and risk profile. When it comes time to file a claim, you’ll be glad you did.

How Energy-Efficient Upgrades May Influence Premiums

Energy-efficient home improvements don’t just bring savings on electricity bills—they can also shift your insurance premiums in ways that surprise many homeowners. Whether you add solar panels, replace old windows, or install high-efficiency HVAC systems, these upgrades catch an insurer’s attention. Some green changes may help reduce what you pay, but specialized systems can sometimes push premiums up. Insurers look closely at the upgraded features, their costs, and the risks or protection they provide.

When Green Upgrades May Lower Your Premiums

Many insurance companies now recognize the lower risk and sustainability benefits of green upgrades. Here’s why they may reward you with lower premiums:

- Reduced risk of damage: Upgrades like impact-resistant windows or better roofing often make homes more weatherproof, cutting the chance of costly claims from storms or leaks.

- Modern systems mean fewer claims: New wiring, plumbing, or HVAC systems often mean less risk of fire or water damage, so insurers may reward these with lower costs.

- Eco-friendly status: More insurers now offer “green” discounts for homes certified by programs like ENERGY STAR or LEED.

It’s not universal, but companies are increasingly offering incentives as energy-efficient features become mainstream. You can see more about common improvements that can shrink your home insurance bill in this breakdown of home upgrades to lower the cost of homeowners insurance.

Some providers even offer additional policy benefits, such as coverage for green materials if you need to rebuild. For an updated take on how efficiency impacts your insurance, check out this article on how an energy-efficient home can impact your home insurance rates.

When Specialized Equipment May Raise Premiums

While many green changes lower risk, certain high-cost upgrades could bump up your insurance premium:

- Solar panels: Installing solar systems often increases your property’s replacement value. Insurers may adjust premiums to reflect the added cost to repair or replace panels.

- Geo-thermal or advanced HVAC: If you install complex or costly mechanical systems, insurance may be higher because these units cost more to fix or replace.

- Battery backups and energy storage: While these improve reliability, the new technology can carry higher replacement costs, which affects the claim totals.

Some energy-efficient features also need special riders or endorsements on your policy, since standard homeowner policies may not fully cover them. Always check with your agent after a major upgrade to guarantee you’re protected.

Different Insurers, Different Rules

Not every company treats green upgrades the same way. Premium calculations depend on how each insurer sees the value and risk that comes from your improvements. One company may view new windows and a smart thermostat as low risk ( offering a notable discount ), while another may add a small premium for expensive add-ons like rooftop solar.

- Shop around before and after upgrades. Getting quotes from several providers lets you compare how green features change your premium.

- Ask about green incentives or add-ons. Some insurers offer “green rebuild” endorsements or unique discounts—sometimes hidden or only available if you ask.

- Check policy fine print: Some companies require extra documentation or periodic value reassessments if you’ve invested in high-value energy systems.

If you want details on how providers are moving toward green solutions, review this comprehensive guide to green home improvements and their effect on insurance policies.

Insurance Discounts and Policy Differences

No two policies are alike, and there’s no guarantee that one specific upgrade will save you money everywhere. But the trend is clear—homes that combine energy efficiency with risk reduction stand to gain the most on their premiums.

Here are a few upgrades more likely to win discounts or special pricing:

- Impact-resistant roofing and windows

- Automated shut-off valves

- High-efficiency electrical or plumbing systems

- Smart home security devices

For more discount opportunities, see how insurance and sustainability connect in this resource on insurance and going green.

Photo by Mikhail Nilov

Choosing the right company is as important as picking the right upgrades. For more tips on reviewing insurance policies and making decisions that best protect your home, explore the guides on choosing your coverage wisely.

Possible Gaps and Limitations in Coverage

Energy-efficient upgrades promise big savings and boost comfort, but these home improvements aren’t always a home run with your insurance policy. Many homeowners expect their new windows or solar panels to be fully protected, only to find out the hard way that coverage isn’t guaranteed. Insurers often set clear limits, exclusions, and requirements for specialized equipment—and these rules can trip up even the most well-prepared homeowner.

Gaps in Standard Home Insurance for Energy Upgrades

Not all upgrades are automatically covered when you update your home. In many cases, adding new technology or specialized systems creates coverage gray areas you might not spot at first glance.

A few typical gaps include:

- Partial coverage for solar panels: Many policies treat solar panels differently from the rest of your home’s structure. If panels are mounted on your roof, they might be covered—but ground installations, detached systems, or leased panels could fall outside your standard policy.

- Manufacturer or installation defects: Most homeowners insurance policies will not pay for losses caused by faulty installation or manufacturer errors. If your new smart thermostat sparks a short due to a factory defect, you may be left on your own to repair it.

- Equipment exclusion: Advanced technology such as backup batteries or geothermal units sometimes require separate endorsements or “riders.” Without this extra coverage, your insurer might refuse to pay claims for expensive repairs or replacement.

These limits are not always obvious, especially when policies contain pages of fine print. For a deeper dive into common barriers faced in upgrading residential buildings, check insights from the Department of Energy’s summary of gaps and barriers for implementing residential energy upgrades.

The Need for Riders and Policy Endorsements

Energy-efficient upgrades are often classified as “specialty property” by insurers. This means they may fall outside the traditional dwelling or personal property coverage. Here’s what you might need to keep your investments protected:

- Solar panel endorsements: Many policies now require you to add a specific solar endorsement for rooftop or ground systems. This finalizes coverage for both storm damage and theft.

- Equipment breakdown coverage: This add-on covers fixes for mechanical or electrical breakdowns that standard policies skip—especially useful for high-end HVAC, water heating, or battery systems.

- Green home endorsements: Some insurance products offer a special rider covering the costs to rebuild or repair with new energy-efficient materials, matching your upgrades after a claim.

Think about these endorsements as an “insulation layer” for your new investments. Without them, your out-of-pocket costs could balloon after any claim. Always confirm with your insurance company which endorsements or upgrades require notice and extra payments; requirements vary widely between providers.

Exclusions to Watch in Policy Fine Print

Insurance companies don’t just set limits—they also write explicit exclusions for certain risks, meaning they will never pay out under those scenarios. For owners with energy-efficient upgrades, the most common exclusions include:

- Damage from poor installation or shoddy materials: If you hire an unlicensed installer for your panels or windows and there’s a failure, insurance usually excludes coverage for related repairs.

- Wear and tear or gradual breakdown: Most policies only cover sudden events, not equipment that fails slowly over time.

- Power surges and grid issues: Unless you have an endorsement for electrical systems, damage from power grid failures or electrical surges could remain uncovered.

To help you compare what’s protected (and what might not be), review the fine print before you buy or upgrade. For more guidance, explore Shielded Future’s overview on specialty insurance coverage for a closer look at handling unique home equipment and add-ons.

Insurer Notification Requirements for Upgrades

When you install big-ticket upgrades, keeping your insurer in the loop pays off. Failing to report major changes can void sections of your coverage or limit claims.

Insurers will often expect you to:

- Tell them about any major retrofit or upgrade, especially if it raises your home value.

- Submit documentation like receipts, work orders, and photos.

- Schedule a value reassessment or home inspection to reset your policy’s limits.

Not sure if you need to report a specific change? Speaking with your agent before any major project is best, which experts strongly encourage in practice (do you need to report home upgrades to your insurer). Many insurers also publish company-specific guidance—see this advice on notifying your insurer after home renovations for common industry standards.

- Failing to report can reduce or even nullify your coverage on those upgrades.

- Insurers might decline your claim if documentation is missing.

Taking the extra step keeps you covered and prevents surprises down the road. For home insurance tips and more guidance, Shielded Future provides detailed info on personal insurance requirements.

Photo by Mikhail Nilov

Tips for Homeowners Considering Energy-Efficient Upgrades

Thinking about making your home more energy-efficient is exciting, but it pays to plan ahead—especially when it comes to your insurance. Smart choices set you up for savings, safety, and fewer headaches down the road. By getting clear on your next steps, you can make sure your new upgrades are both protected and rewarding.

Photo by Robert So

Talk to Your Insurance Agent Before Making Upgrades

Start with a conversation. Your insurance agent can help you understand how each planned upgrade could impact your coverage or premiums. This isn’t just a courtesy—it’s one of the best ways to prevent unwanted surprises at claim time.

Tips for a successful agent discussion:

- Outline your plans: Share a simple list of what you plan to upgrade—windows, insulation, solar, or smart systems.

- Ask about coverage gaps: Make it clear you want to know if your policy covers repairs, replacements, and special systems.

- Discuss premium impacts: Find out whether certain upgrades might lead to discounts or trigger higher premiums.

- Request written guidance: Ask your agent for confirmation or advice in writing. This step keeps you covered if staff or policy details change later.

Open and honest communication helps you avoid classic insurance pitfalls. For more help on choosing the right policy for your situation, see this easy-to-follow guide to picking the right insurance policy.

Keep Documentation and Update Your Coverage

Energy upgrades can increase your home’s value and require special protection. Insurance companies usually ask for proof if you want expanded coverage or need to file a claim.

Ways to stay organized:

- Save all receipts for upgrades, installations, and inspections.

- Take photos of new features before, during, and after installation.

- Keep permits and warranties on file, even for simple improvements.

- Ask for an updated appraisal if your upgrades are significant.

Once you finish the project, call or email your insurance agent and update your policy limits. This adjustment keeps your investment secured and ensures full coverage for your improved home.

Reference Helpful Resources and Stay Informed

Upgrading isn’t just about installing new equipment. It’s about keeping up with changing rules and learning from others. Take advantage of insurance resources, expert articles, and reputable websites.

Here are some ways to stay smart:

- Subscribe to insurance news to catch updates on policy rules or discounts for green homes.

- Reading detailed guides like the ones you’ll find on Shielded Future helps you compare home policies and spot common pitfalls.

- Consult with licensed professionals for large upgrades—especially ones involving electricity, roofing, or plumbing.

When in doubt, reach for expert insights first. Shielded Future’s archive of personal insurance tips can keep you a step ahead.

Making energy-efficient choices for your home drives comfort and savings, but only if you’re protected along the way. Following these tips lets you move forward with confidence and peace of mind.

Conclusion

Energy-efficient home upgrades bring the promise of lower costs and extra comfort, but they also have a direct effect on your insurance policy. Reviewing your coverage before starting upgrades safeguards both your investments and your finances. Taking time to consult your insurance provider and keeping documentation clear helps you avoid coverage issues, gaps, or unexpected premium changes.

Every step you take toward energy efficiency should align with smart insurance planning. Staying informed and making updates as needed means your policy will support your long-term goals—saving money, boosting resilience, and protecting what matters most.

For more guidance on keeping your insurance current with home improvements, explore expert resources on updating your insurance policy after home changes. Thank you for reading—if you’ve made recent upgrades or have questions about coverage, share your experience or reach out for advice. Your commitment to smart choices pays off today and strengthens your future security.