Full coverage auto insurance includes liability, collision, and comprehensive coverage. But, what are the limits for full coverage auto insurance?

Understanding these limits helps you know what to expect when you need to make a claim. Auto insurance can be confusing, especially with all the terms and limits. Full coverage sounds like it covers everything, but it has its boundaries.

These limits vary by policy and insurer. Knowing your coverage limits means knowing how much protection you have. This can save you from unexpected costs after an accident. In this post, we will explore the limits of full coverage auto insurance. This will help you make better decisions about your policy and protect your financial future. Let’s dive into the details and understand what full coverage really means for you.

Credit: harlingencarcrashattorney.com

Basics Of Full Coverage Auto Insurance

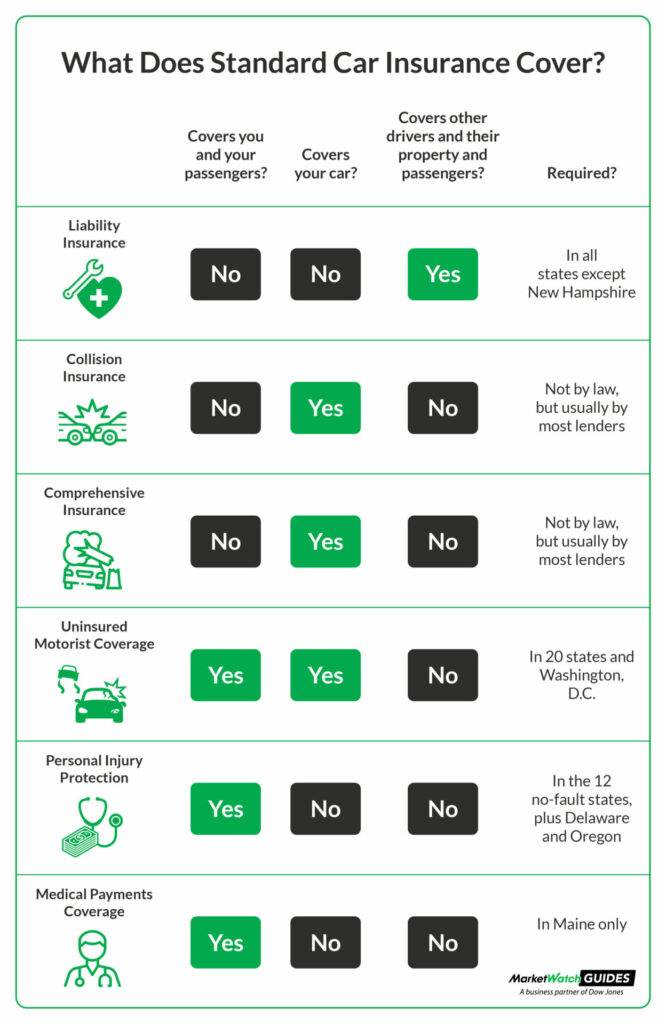

Full coverage auto insurance is a term often used by drivers. It refers to a combination of different types of car insurance. This type of insurance offers extensive protection. It includes liability, collision, and comprehensive coverage. Understanding full coverage is essential for every driver.

Definition Of Full Coverage

Full coverage does not mean your car is insured for every possible event. It is a combination of several types of insurance coverages. These coverages work together to offer broad protection. Full coverage usually includes liability, collision, and comprehensive insurance.

Components Of Full Coverage

Full coverage auto insurance has three main components:

- Liability Insurance: This covers damages you cause to other drivers and their property. It includes bodily injury and property damage.

- Collision Insurance: This covers damages to your car from a collision. It applies whether you hit another car or an object.

- Comprehensive Insurance: This covers damages not related to collisions. It includes theft, fire, natural disasters, and vandalism.

These components together provide extensive protection. They help ensure you are covered in various situations.

Liability Coverage Limits

Full coverage auto insurance includes liability coverage limits. These limits protect you if you’re responsible for an accident. Understanding these limits can help you choose the right policy. Let’s explore the two main types of liability coverage limits.

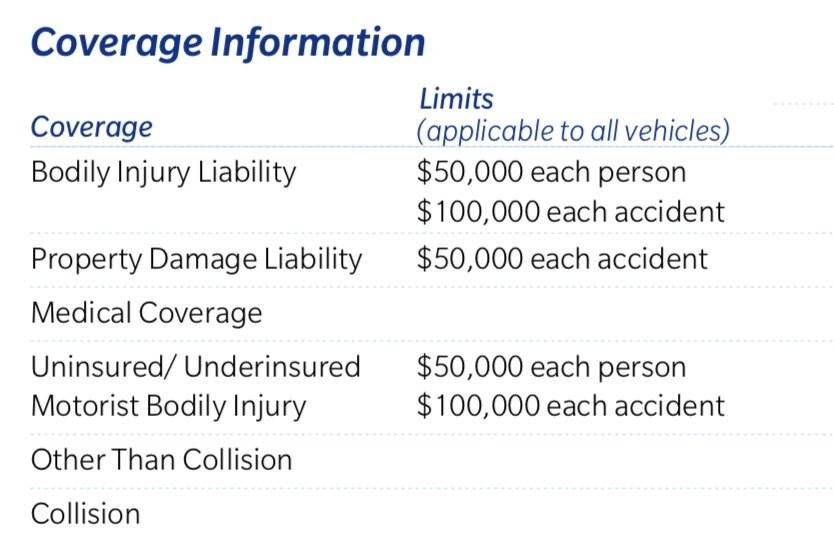

Bodily Injury Liability

Bodily Injury Liability covers medical expenses if you injure someone in a car accident. It also covers legal fees if you’re sued. Each state sets a minimum limit for this coverage.

Typical limits are split into two parts:

- Per person limit: The maximum amount paid for one person’s injuries.

- Per accident limit: The maximum amount paid for all injuries in one accident.

For example, a policy might have limits of $50,000 per person and $100,000 per accident. This means up to $50,000 for one person’s injuries and up to $100,000 for all injuries in one accident.

Property Damage Liability

Property Damage Liability covers the cost to repair or replace another person’s property. This includes their car, fence, or building. Each state also sets a minimum limit for this coverage.

Common limits for property damage liability range from $10,000 to $50,000. For instance, if your policy has a $25,000 limit, that’s the maximum amount paid for property damage in one accident.

Choosing higher limits can provide better protection. It can cover more expensive damages and reduce out-of-pocket costs.

| Type of Liability | Common Limits |

|---|---|

| Bodily Injury (Per Person) | $25,000 – $50,000 |

| Bodily Injury (Per Accident) | $50,000 – $100,000 |

| Property Damage | $10,000 – $50,000 |

Review your policy and state requirements. Ensure you have adequate coverage for your needs.

Collision Coverage Limits

Understanding collision coverage limits is essential for all drivers. This coverage helps repair or replace your vehicle after an accident. Knowing your limits can save you from unexpected costs. Let’s explore the details.

Damage From Accidents

Collision coverage pays for damage from accidents. This includes collisions with other vehicles or objects. It does not cover damage from theft or weather. The amount paid depends on your coverage limits and the accident’s cost.

Deductibles And Payouts

Each policy has a deductible. This is the amount you pay before insurance kicks in. For example, if your deductible is $500 and the repair costs $2,000, you pay $500, and insurance covers $1,500. Higher deductibles often mean lower premiums, but more out-of-pocket costs during a claim.

Your payout is the maximum amount the insurance will pay. This can be up to the car’s actual cash value minus the deductible. Consider the value of your vehicle when choosing coverage limits.

| Factor | Explanation |

|---|---|

| Deductible Amount | The portion you pay before insurance contributes. |

| Actual Cash Value | The car’s worth at the time of the accident. |

| Coverage Limits | The maximum payout from your insurance. |

- Choose a deductible you can afford.

- Consider the actual cash value of your car.

- Understand your policy’s coverage limits.

Comprehensive Coverage Limits

Comprehensive coverage is essential for protecting your vehicle from non-collision incidents. It provides financial protection against various risks that are not due to a crash. Understanding the limits of comprehensive coverage helps you know the extent of your protection.

Non-collision Incidents

Comprehensive coverage protects you from non-collision incidents. These can include weather-related damages like hail, floods, and storms. If a tree falls on your car, comprehensive coverage steps in.

Other non-collision incidents include fire damage and damage from animals. For instance, if a deer hits your car, comprehensive coverage applies.

Theft And Vandalism

Theft and vandalism are also covered under comprehensive insurance. If your car gets stolen, this coverage helps you recover the loss. It also covers damages caused by attempted theft.

Vandalism can result in significant repair costs. Comprehensive coverage ensures you are financially protected. This includes damages like broken windows, slashed tires, and graffiti on your vehicle.

Here is a quick look at some of the common non-collision incidents covered:

- Weather-related damages (hail, flood, storms)

- Fire damage

- Damage from animals (deer, raccoons)

- Theft and attempted theft

- Vandalism (broken windows, slashed tires, graffiti)

Comprehensive coverage limits can vary by insurer. Be sure to review your policy to know the exact limits and what is covered.

Personal Injury Protection Limits

Personal Injury Protection (PIP) is a vital component of full coverage auto insurance. It covers medical costs and lost wages if you’re injured in an accident. Each state sets its own limits for PIP coverage. Understanding these limits helps you choose the right policy.

Medical Expenses

PIP covers medical expenses resulting from an accident. This includes doctor visits, hospital stays, surgeries, and rehabilitation. The coverage amount varies by state. For instance, in Florida, the minimum PIP limit is $10,000. In Michigan, it’s unlimited for necessary medical costs. Some states offer optional PIP coverage, while others require it.

To find the best coverage, check your state’s minimum requirements. Compare them with your medical needs. A higher limit may mean higher premiums, but it ensures better protection.

Lost Wages

PIP also covers lost wages if you’re unable to work due to accident injuries. This financial support is crucial during recovery. Again, the limit varies by state. For example, Texas offers up to 80% of lost wages, capped at $2,500 per month. In New York, the PIP limit for lost wages is $2,000 per month.

To manage your finances effectively, review your state’s PIP lost wage limits. Consider your monthly income and how long you might need support. Higher limits provide more comprehensive coverage, but may increase your premium.

Here’s a quick comparison of some state PIP limits:

| State | Medical Expenses Limit | Lost Wages Limit |

|---|---|---|

| Florida | $10,000 | 60% of lost wages |

| Michigan | Unlimited | 85% of lost wages |

| New York | $50,000 | $2,000 per month |

Understanding PIP limits helps you choose the right auto insurance policy. It ensures you receive necessary medical care and financial support during recovery.

Credit: www.marketwatch.com

Uninsured/underinsured Motorist Coverage Limits

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you get into an accident with a driver who has no insurance or not enough insurance. This coverage ensures you are not left paying for damages out of your pocket. Understanding these limits can help you make informed decisions.

Protection Against Uninsured Drivers

Uninsured motorist coverage comes into play if you are hit by a driver with no insurance. This coverage helps pay for your medical expenses, lost wages, and other damages.

Consider this scenario: You have $50,000 in uninsured motorist bodily injury coverage. If an uninsured driver hits you and you incur $40,000 in medical bills, your coverage will handle these costs.

Here’s what uninsured motorist coverage typically includes:

- Medical expenses: Covers hospital bills and medical treatments.

- Lost wages: Compensates you if you are unable to work.

- Property damage: Covers damage to your vehicle.

It’s crucial to review your policy limits. Make sure they align with your potential needs.

Underinsured Motorist Situations

Underinsured motorist coverage kicks in if the at-fault driver’s insurance is insufficient to cover your costs. This coverage fills the gap between their policy limits and your expenses.

For example, if your medical bills total $60,000 and the at-fault driver’s insurance only covers $30,000, your underinsured motorist coverage would cover the remaining $30,000.

Here are some key points about underinsured motorist coverage:

| Scenario | Coverage |

|---|---|

| Medical expenses | Coverage for hospital and medical costs exceeding the at-fault driver’s limits. |

| Lost wages | Compensation for income lost due to the accident. |

| Property damage | Coverage for vehicle repairs not covered by the at-fault driver. |

Ensuring you have adequate underinsured motorist coverage is vital. It protects you from significant financial loss.

Both uninsured and underinsured motorist coverage are essential components of your auto insurance policy. Review your policy today and adjust the limits if necessary. This way, you ensure you are fully protected in any situation.

State-specific Coverage Requirements

Auto insurance laws differ by state in the U.S. Each state sets its own regulations. These regulations affect the minimum coverage levels that drivers must carry. Understanding your state’s specific requirements can help you stay compliant and avoid fines. Here, we will discuss the minimum coverage levels and the variations across different states.

Minimum Coverage Levels

Each state mandates minimum coverage levels. These levels include liability, personal injury protection, and uninsured motorist coverage. Below is a table outlining common minimum coverage requirements:

| Coverage Type | Minimum Requirement |

|---|---|

| Liability (Bodily Injury) | $25,000 per person / $50,000 per accident |

| Liability (Property Damage) | $20,000 per accident |

| Personal Injury Protection (PIP) | $10,000 |

| Uninsured Motorist | $25,000 per person / $50,000 per accident |

These are typical figures. Always verify with your local DMV for exact requirements.

State Variations

Insurance requirements vary by state. For example, California has different rules than Texas. Here are a few key variations:

- California: Requires $15,000 per person and $30,000 per accident for bodily injury.

- Florida: Only requires $10,000 in personal injury protection.

- New York: Requires $25,000 per person and $50,000 per accident for bodily injury.

Some states, like New Hampshire, do not mandate auto insurance at all. Instead, they require proof of financial responsibility. This means showing you can cover accident costs.

Knowing your state-specific requirements is crucial. It ensures you have the right coverage and helps you avoid penalties.

Factors Influencing Coverage Limits

When choosing full coverage auto insurance, various factors determine your coverage limits. Understanding these factors can help you make informed decisions. Here, we explore the key elements that affect your coverage limits.

Vehicle Value

The value of your vehicle plays a significant role in determining your coverage limits. Higher-value cars often require higher coverage limits to ensure adequate protection.

| Vehicle Type | Estimated Value | Recommended Coverage |

|---|---|---|

| Sedan | $20,000 | $50,000 |

| SUV | $30,000 | $75,000 |

| Luxury Car | $50,000+ | $100,000+ |

Insurance providers assess your car’s market value to determine appropriate coverage limits. A new, expensive car needs more coverage than an older, less valuable one.

Driver’s Risk Profile

Insurance companies evaluate your risk profile to set coverage limits. They consider various factors to assess your risk level.

- Age: Younger drivers often face higher premiums and coverage limits due to inexperience.

- Driving History: A clean driving record can result in lower premiums and higher coverage limits.

- Location: Living in a high-crime area may increase your risk profile, affecting coverage limits.

- Credit Score: A higher credit score can lead to better insurance rates and coverage limits.

Each of these factors contributes to your overall risk profile. A lower risk profile can lead to more favorable coverage limits and premiums.

Credit: www.connectbyamfam.com

Frequently Asked Questions

What Is Full Coverage Auto Insurance?

Full coverage auto insurance typically includes liability, collision, and comprehensive coverage. It provides extensive protection against various damages and accidents.

Does Full Coverage Cover Rental Cars?

Yes, full coverage often includes rental car coverage. Check with your insurer to confirm specific details and limitations.

Are There Coverage Limits In Full Coverage Insurance?

Yes, full coverage insurance has coverage limits. These limits vary by policy and insurer. Review your policy for specifics.

How Much Does Full Coverage Insurance Cost?

The cost varies based on factors like your vehicle, driving history, and location. Contact insurers for personalized quotes.

Conclusion

Understanding full coverage auto insurance limits is essential. These limits protect your finances. You need to know what your policy covers. Check your policy details carefully. This helps avoid surprises in case of accidents. Always ensure you have adequate coverage.

Speak with your insurance agent if needed. They can explain your options clearly. Being informed keeps you safe and secure. Make smart choices about your auto insurance. This way, you stay protected on the road.

You might be interested in understanding the different components of auto insurance and how they work together. Speaking of coverage, you may want to explore the concept of liability coverage, which is fundamental to automotive insurance policies. Additionally, if you’re curious about how different states handle insurance regulations, check out the details on insurance regulation in the U.S. Furthermore, learning about comprehensive coverage can give you insight into how it protects against various non-collision incidents. These resources can enhance your understanding of how full coverage auto insurance operates and what limits you should consider.

2 thoughts on “What are the Limits for Full Coverage Auto Insurance: Explained”