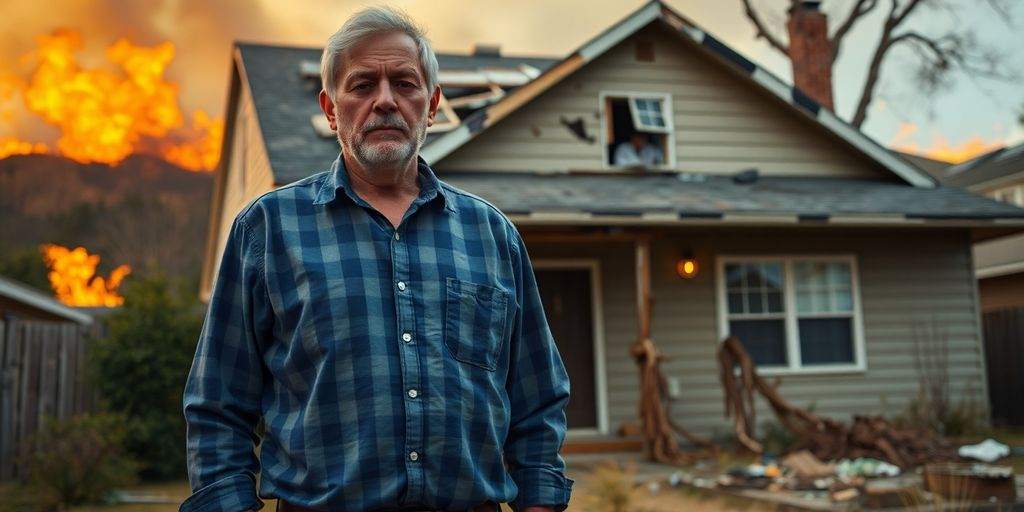

California confronts a grave insurance quandary. Wildfires exacerbate this crisis. Coverage options diminish considerably. Homeowners and businesses struggle. Major insurers are departing the state. They cite escalating wildfire risks. Residents now seek alternatives. Costs often rise substantially.

Insurers curtail policy offerings. Some entirely withdraw from California. Homeowners increasingly rely on the FAIR Plan. It offers limited coverage. Premiums remain elevated. New rules may inflate costs further. Fire-prone areas bear the brunt.

Wildfires in Los Angeles prompt insurer exits. Companies cease new policy issuances. They abandon the California market. Many homeowners lack adequate coverage. They scramble for alternatives. These options carry higher costs. Protection becomes less comprehensive.

Between 2020 and 2022, insurers rejected renewals. This impacted 2.8 million policies. Many cancellations occurred in high-risk zones. The Department of Insurance documents a surge. Cancelled policies leave residents exposed. They face significant financial losses.

Several major insurers reduced presence. Allstate paused new sales in 2022. State Farm terminated 72,000 policies. They cited increasing building expenses. Farmers Insurance Group limited coverage. They completely exited the state. Chubb significantly decreased coverage. This occurred over three years.

The FAIR Plan acts as a last resort. It is a state-backed program. It aids those unable to secure private insurance. This plan presents unique difficulties. Premiums are often dearer. Coverage remains constrained. Homeowners often need additional protection. The plan’s exposure increased by 61%. This occurred in one year. Demand has dramatically amplified.

The Department of Insurance has promulgated new regulations. These seek to lure insurers back. Insurers must write policies. They must match 85% of market share. This applies in fire-prone areas. Critics suggest this will elevate premiums. They say this burden will fall on homeowners.

Consumer groups warn of potential increases. Rates could climb 40% to 50%. Residents will face increased financial burdens. They already struggle with wildfire effects. Reinsurance costs escalate. Inflation contributes to rate hikes.

California’s insurance crisis is complex. It presents substantial hurdles. This impacts homeowners and small businesses. Wildfires continue to imperil the state. The insurance landscape rapidly transforms. Residents are left in vulnerable circumstances. Costs may escalate. Options remain restricted. Policymakers must find solutions. They must safeguard both consumers and insurers.

Sources

- California insurance crisis: Here are the carriers that have fled or reduced coverage in the state | Fox Business, Fox Business.

- California’s insurance is in crisis. The solution will cost homeowners a ton | CNN Business, CNN.

- Insurer insolvencies and California withdrawals could follow wildfires – report | Insurance Business America, Insurance Business America.