Car insurance costs can vary greatly. One key factor is the insurance group of your car.

Understanding car insurance groups is crucial for managing your expenses. Each car model falls into a specific insurance group, ranging from 1 to 50. These groups help insurers determine the risk and cost of covering different vehicles. Generally, cars in lower groups are cheaper to insure, while those in higher groups cost more.

Various factors like car performance, repair costs, and safety features influence these groups. Knowing where your car stands can save you money. In this blog, we’ll explore the price differences between car insurance groups, helping you make informed decisions.

Car Insurance Groups

Understanding car insurance groups is vital. It helps you know your insurance costs. These groups categorize cars based on their risk levels. Let’s explore what they are and why they matter.

Definition And Importance

Car insurance groups are categories. They rank cars from 1 to 50. Group 1 cars are the cheapest to insure. Group 50 cars are the most expensive.

Insurance companies use these groups. They help determine your premium. Knowing your car’s group can save you money. It helps you choose a car with lower insurance costs.

Classification Criteria

Several factors decide a car’s insurance group. Here are some key criteria:

- Car Value: Expensive cars cost more to repair or replace.

- Repair Costs: Easier and cheaper repairs lower the group.

- Parts Prices: Lower parts costs reduce the insurance group.

- Performance: Faster cars are in higher groups. They are riskier to insure.

- Safety Features: More safety features can lower the group.

Below is a table showing examples of car insurance groups and their characteristics:

| Insurance Group | Car Examples | Key Characteristics |

|---|---|---|

| 1-10 | Small city cars | Low cost, easy to repair |

| 11-20 | Compact family cars | Moderate cost, good safety features |

| 21-30 | Mid-size cars | Higher cost, advanced safety |

| 31-40 | Luxury cars | High value, expensive repairs |

| 41-50 | Sports cars | Very high cost, high performance |

Credit: www.bymiles.co.uk

Factors Influencing Insurance Premiums

Understanding the factors that influence car insurance premiums is essential. Different elements impact how much you will pay for your car insurance. These factors can vary widely, making it important to know how each one affects your costs.

Vehicle Value

The value of your vehicle plays a significant role in determining your insurance premium. High-value cars generally lead to higher insurance costs. Insurers charge more because high-value vehicles are more expensive to repair or replace. If you drive a luxury car, expect to pay more for insurance. Lower-value cars often come with lower premiums.

Engine Size

Engine size is another critical factor influencing insurance premiums. Cars with larger engines typically have higher premiums. This is because they can reach higher speeds and pose more risk. Insurers see high-performance vehicles as more likely to be involved in accidents. Smaller engine vehicles generally attract lower premiums. They are seen as less risky and more economical to insure.

Safety Features

Safety features in your vehicle can affect your insurance costs. Cars equipped with advanced safety features often enjoy lower premiums. Features like anti-lock brakes, airbags, and electronic stability control reduce the risk of accidents. Insurers offer discounts for vehicles with these features. Enhanced safety means fewer claims and lower costs for the insurer.

Price Variations Among Groups

Understanding price variations among car insurance groups can help you make informed choices. Car insurance groups range from 1 to 50. Group 1 cars are the cheapest to insure, while Group 50 cars are the most expensive.

Low Group Costs

Cars in Groups 1-10 often have the lowest insurance premiums. These cars are typically small, low-powered, and inexpensive to repair.

- Low repair costs

- Lower accident risk

- Affordable parts

Some popular models in these groups include:

| Car Model | Group | Annual Premium |

|---|---|---|

| Ford Fiesta | 1 | $500 |

| Volkswagen Polo | 5 | $550 |

| Hyundai i10 | 3 | $520 |

High Group Costs

Cars in Groups 40-50 have the highest insurance premiums. These cars are often luxury or high-performance vehicles.

- High repair costs

- Higher accident risk

- Expensive parts

Some popular models in these groups include:

| Car Model | Group | Annual Premium |

|---|---|---|

| Mercedes-Benz S-Class | 50 | $2,000 |

| BMW 7 Series | 47 | $1,900 |

| Audi A8 | 48 | $1,950 |

Choosing a car from a lower insurance group can help you save money. Always check the insurance group before buying a car.

Credit: www.carbase.co.uk

Impact Of Driver Profile

The driver profile has a significant impact on car insurance prices. Insurance companies use various factors to determine the risk associated with insuring a driver. These factors include age, driving experience, and driving record. Understanding how these elements affect insurance groups can help drivers make informed decisions.

Age And Experience

Age and experience are key factors in determining car insurance costs. Younger drivers, especially teenagers, often face higher premiums. This is due to their lack of experience and higher risk of accidents.

Insurance companies view young drivers as high-risk. Therefore, they charge more to cover potential claims. On the other hand, older drivers with more experience usually benefit from lower rates.

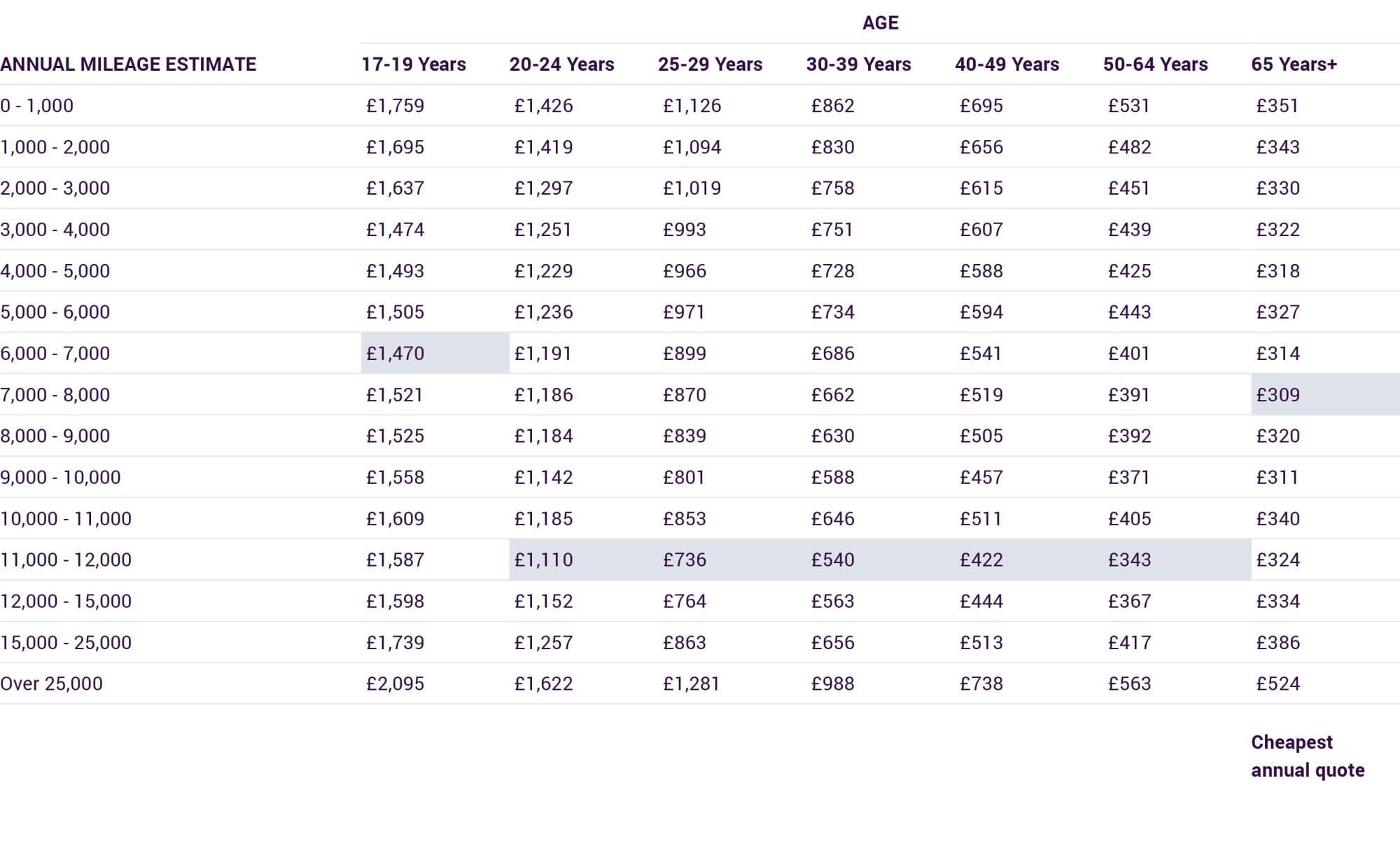

Consider the following table illustrating the impact of age on car insurance rates:

| Age Group | Average Annual Premium |

|---|---|

| 17-20 | $3,500 |

| 21-25 | $2,200 |

| 26-30 | $1,800 |

| 31-40 | $1,400 |

| 41-50 | $1,200 |

| 51 and above | $1,000 |

Driving Record

A clean driving record can significantly lower insurance costs. Drivers with no accidents or traffic violations are seen as low-risk. This leads to more affordable insurance premiums.

Conversely, a history of accidents or tickets increases premiums. Insurance companies consider these drivers high-risk. The more serious the violation, the higher the impact on insurance costs.

Here are some common factors that affect insurance rates based on driving records:

- Speeding tickets

- At-fault accidents

- DUI/DWI convictions

- Reckless driving

Maintaining a good driving record over time can help reduce insurance costs. Safe driving habits and following traffic laws are essential for keeping premiums low.

Regional Price Differences

Car insurance prices vary significantly based on regional factors. The location where you live impacts your insurance premium. Factors such as population density, crime rate, and state regulations play a crucial role in determining these differences. Let’s explore how these factors influence car insurance prices.

Urban Vs Rural

Urban areas tend to have higher car insurance premiums compared to rural areas. This is due to several reasons:

- Higher traffic congestion leading to more accidents

- Increased risk of theft and vandalism

- More expensive repair costs due to higher living costs

On the other hand, rural areas benefit from lower premiums because:

- Less traffic reduces the likelihood of accidents

- Lower crime rates

- Cheaper repair services

State Regulations

Each state has different car insurance regulations. These regulations can affect the price significantly. Some states have mandatory minimum coverage requirements which can drive up the cost. For example:

| State | Minimum Coverage Requirements | Average Premium |

|---|---|---|

| California | 15/30/5 | $1,500 |

| Texas | 30/60/25 | $1,200 |

| Florida | 10/20/10 | $2,000 |

Some states also have no-fault insurance laws, which means each driver’s insurance covers their damages regardless of who caused the accident. This can increase premiums because insurers pay out claims more frequently.

Regulatory differences also include how states handle uninsured drivers. States with a high number of uninsured drivers often have higher premiums to offset the risk.

Ways To Reduce Insurance Costs

Car insurance can be expensive. But there are ways to lower your costs. By making smart choices, you can keep more money in your pocket. Below, we explore some effective ways to reduce your car insurance costs.

Comparing Quotes

One of the best ways to save is by comparing quotes. Different insurance companies offer different rates. By gathering multiple quotes, you can find the best deal.

Here’s how you can compare quotes effectively:

- Use online comparison tools.

- Check rates from at least three insurers.

- Look at the coverage details, not just the price.

Spend some time comparing. It could save you hundreds of dollars a year.

Increasing Deductibles

Another way to lower your insurance cost is by increasing your deductibles. A deductible is what you pay out of pocket before insurance covers the rest.

Here’s an example of how it works:

| Deductible Amount | Monthly Premium |

|---|---|

| $200 | $150 |

| $500 | $120 |

| $1,000 | $90 |

As shown, higher deductibles mean lower monthly premiums. Choose a deductible you can afford in case of an accident.

Bundling Policies

Bundling policies can also reduce your insurance costs. This means getting multiple insurance products from the same provider. For example, you could bundle your car and home insurance.

Benefits of bundling include:

- Discounts on both policies.

- Convenience of dealing with one insurer.

- Possibly better customer service.

Ask your current insurer about bundling options. You might qualify for significant savings.

By comparing quotes, increasing deductibles, and bundling policies, you can effectively reduce your car insurance costs. Implement these strategies and see how much you can save.

Choosing The Right Insurance Group

Choosing the right car insurance group can save you money and provide the coverage you need. Different insurance groups offer varying levels of protection and cost. Understanding your needs and budget helps in making the best decision.

Assessing Needs

First, assess your needs. Consider the type of car you drive. Is it a luxury vehicle or a basic model? Luxury cars often fall into higher insurance groups. This means higher premiums. Think about your driving habits. Do you drive daily or occasionally? Frequent drivers may need more comprehensive coverage. Also, consider your driving record. A clean record usually means lower insurance costs.

Evaluating Budget

Next, evaluate your budget. Know how much you can afford to spend on car insurance. Higher insurance groups generally mean higher premiums. Create a table to compare different groups:

| Insurance Group | Average Annual Premium |

|---|---|

| 1-10 | $600 – $1,000 |

| 11-20 | $1,000 – $1,500 |

| 21-30 | $1,500 – $2,000 |

| 31-40 | $2,000 – $3,000 |

Use this table to see where your car fits. This helps in planning your budget.

Consider additional factors affecting your budget:

- Age and experience: Younger drivers often face higher premiums.

- Location: Urban areas can have higher rates due to higher risks.

- Mileage: Higher mileage may lead to higher costs.

Choose an insurance group that balances your needs and budget. This ensures you get the best value for your money.

Credit: glassbytes.com

Future Trends In Car Insurance Pricing

The car insurance market is constantly evolving. Prices fluctuate due to various factors. Understanding future trends can help you make informed decisions. Let’s explore the key aspects that will shape car insurance pricing in the coming years.

Impact Of Technology

Technology is playing a major role in car insurance pricing. New advancements are changing how insurers assess risk and determine premiums. Here are some key technological influences:

- Telematics: Devices that monitor driving behavior can lead to personalized premiums. Safe drivers may see reduced rates.

- Autonomous Vehicles: Self-driving cars could lower accident rates. This might result in cheaper insurance.

- AI and Machine Learning: These technologies help predict risks more accurately. Insurers can offer more competitive pricing.

Insurers are investing heavily in these technologies. The goal is to provide better services and more accurate pricing.

Changes In Legislation

Legislative changes impact car insurance pricing significantly. Governments often update regulations to enhance road safety and protect consumers. Here are some recent legislative trends:

- Data Protection Laws: Insurers must comply with stricter data protection regulations. This may increase operational costs, affecting premiums.

- Environmental Policies: Policies promoting electric vehicles can influence insurance rates. Electric cars often have different risk profiles.

- Mandatory Coverage Requirements: Changes in mandatory coverage laws can affect pricing. More comprehensive coverage requirements usually lead to higher premiums.

Staying informed about these changes can help you anticipate shifts in car insurance costs.

Frequently Asked Questions

What Are Car Insurance Groups?

Car insurance groups classify cars from 1 to 50 based on risk. Lower groups mean cheaper insurance premiums. Higher groups mean more expensive premiums.

How Do Insurance Groups Affect Prices?

Insurance groups affect prices by determining the risk level. Lower groups have lower premiums. Higher groups have higher premiums.

Why Do Insurance Groups Vary?

Insurance groups vary due to factors like car performance, repair costs, and safety features. Higher risk leads to higher group.

Can I Reduce My Car’s Insurance Group?

You can’t change the group, but choosing a car with a lower group can reduce insurance costs.

Conclusion

Understanding car insurance groups can save you money. Different groups mean different premiums. Lower groups often have cheaper insurance. Higher groups usually cost more. Consider your car’s group before buying insurance. Compare rates from different providers. This helps you find the best deal.

Always choose coverage that fits your needs. Remember, a little research can make a big difference. Happy driving!

You might be interested in exploring more about how car insurance works. Speaking of car insurance groups, you may want to check out the basics of car insurance and how they affect premiums. Additionally, understanding insurance in general can provide insight into the factors that determine your costs. Finally, learning about automobile features and their impact on insurance rates may also be beneficial. Each of these topics is closely related and can help you make informed decisions regarding your car insurance.