Cybersecurity startups face challenges that standard insurance just can’t address. The risks of data breaches, ransomware, and liability claims put your business in a tough spot. Off-the-shelf policies often leave gaps in coverage, exposing your company to financial losses and reputational damage.

That’s why custom coverage plans matter. They’re built to cover the specific threats your startup faces, not just generic risks. With the right insurance, you get protection tailored to your technology, your workflows, and your clients’ demands. For a deeper look at how insurance can protect your business assets, explore our guide on business insurance essentials.

Choosing a specialized plan doesn’t just protect your company—it helps build trust with partners and investors. Getting the details right now means you can focus on growing your business with less worry.

Unique Insurance Challenges for Cybersecurity Startups

Cybersecurity startups face specialized insurance concerns that can make or break their future. These risks are not only technical—they often center on the responsibilities imposed by regulations, the fine print of client contracts, and the complexity of workforce and partner relationships. Unlike broader tech companies, cybersecurity startups are held to higher standards and experience escalating threats as attackers and requirements shift. Here’s a closer look at the obstacles shaping your insurance needs.

Evolving Regulatory Requirements for Data Protection

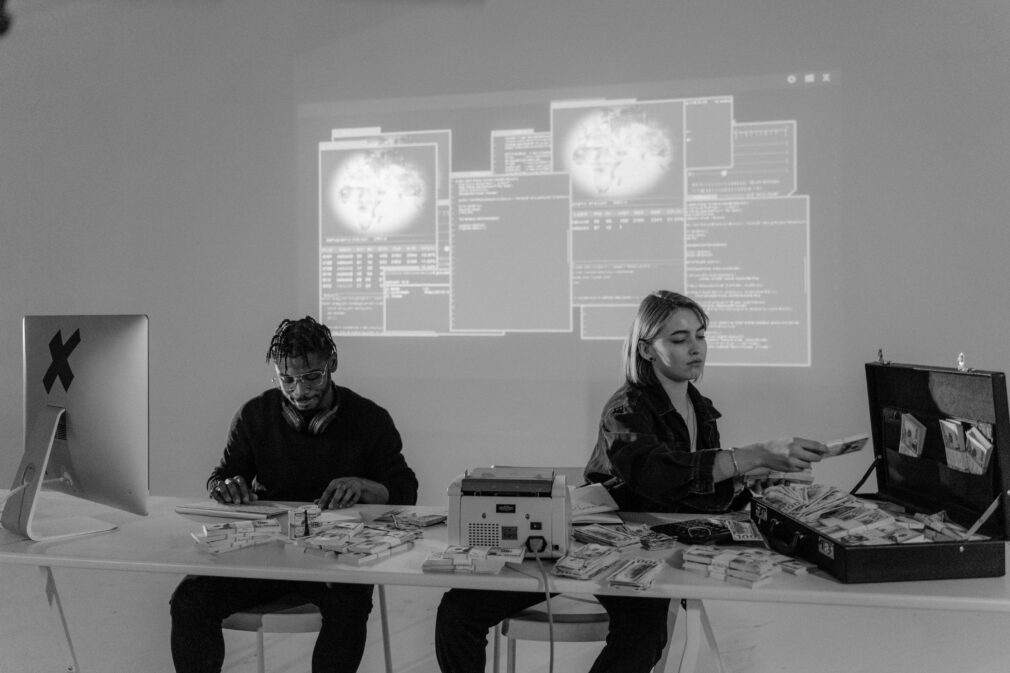

Photo by Tima Miroshnichenko

Photo by Tima Miroshnichenko

Laws about data privacy and cybersecurity change quickly, often with steep penalties for mistakes. Startups must respond to legal frameworks like the GDPR, CCPA, and other standards that dictate how you store, use, and protect sensitive information. Many rules are not optional—failure to comply can trigger audits, fines, lawsuits, or even being shut out of certain markets.

What does this mean for your insurance? Most standard tech policies miss important coverage tied to privacy fines or regulatory investigations. Insurers expect you to stay compliant—if you’re not, you might find your policies won’t pay out when you need them. As new rules emerge, your insurance plan must keep up.

For a breakdown of the compliance maze affecting early-stage companies, check out this insightful resource on key cybersecurity regulations for startups. You’ll want to choose policies that address these unpredictable risks, not just today’s laws but tomorrow’s changes as well.

Client Contractual Obligations and Liability

Every new client or vendor relationship comes with a set of promises—often spelled out in long, complex contracts. Cybersecurity customers are demanding, and your company may face strict requirements regarding data handling, breach reporting, and liability for losses. Sometimes you’re on the hook for much more than expected.

Here’s why that matters:

- Many contracts shift liability for a data breach directly onto the startup, not the client.

- Some require insurance policies to name clients as additional insureds or guarantee minimum coverage.

- Failure to comply can kill deals or expose your business to costly lawsuits.

Traditional insurance rarely covers every scenario tossed into these agreements. Gaps can leave you paying out of pocket for claims tied to contract breaches or client-specific demands. Before signing, review every line with an expert and double-check that your insurance meets contract standards.

Dive into best practices for risk assessment and cyber security restrictions in client contracts to avoid unwelcome surprises and ensure you’re not left vulnerable.

Third-Party and Insider Threats

Your own team is just one piece of the puzzle. Most cybersecurity attacks now involve outsiders like vendors, service providers, or partners who have access to sensitive systems and data. When these third parties make mistakes or act maliciously, your startup can be liable for every consequence.

On top of that, insider threats—accidental or deliberate—remain a leading cause of breaches. Employees may overlook security steps or, worse, exploit their access for personal gain. These events often fly under the radar until damage is done.

Key exposures include:

- Unauthorized data sharing or theft by partners or staff.

- Contractors or IT vendors accidentally exposing your clients’ systems.

- Insider attacks that bypass traditional security controls, costing millions.

Insurance for these threats should extend beyond basic cyber coverage. You need protection for your connections—not just your core team. Learn more about why third-party and insider risk is an overlooked threat for security-focused startups and what additional safeguards insurers may demand before issuing a policy.

For insight into insurance solutions that tackle these risks around your workforce and business relationships, review our article on business liability insurance. It explains how proper coverage can act as your final safety net.

What Makes a Coverage Plan Custom?

A custom coverage plan shapes insurance around the exact risks, assets, and exposures faced by your cybersecurity startup. Unlike off-the-shelf options, these plans target the challenges that come with protecting client data, handling sensitive systems, and meeting strict regulations. Each policy detail—what’s covered, what’s limited, and what’s excluded—can be tailored to keep your business secure and competitive as the threat landscape shifts. Below, we break down what goes into building a plan that’s more than just a template.

Key Insurance Components for Cybersecurity Startups

A strong custom policy bundles together key types of protection that every cybersecurity startup needs. While the basics like general liability and property insurance are part of the picture, a truly tailored plan adds protections that go deep into your technical and operational risks:

- Cyber and Data Breach Coverage: Covers the costs of investigating, managing, and recovering from a cyberattack or data exposure. This is the core of any plan for cybersecurity companies.

- Errors & Omissions (E&O) Insurance: Shields you from claims that a client lost money as a result of your services or advice.

- Technology Professional Liability: Protects against lawsuits if a tech solution you provide fails, causes outages, or opens security holes.

- Regulatory Defense and Penalties: Covers fines, defense costs, and settlements arising from breaching privacy regulations such as GDPR or CCPA.

- Media Liability: Insures risks tied to publishing, including copyright breaches or defamation in digital content and software.

- Business Interruption: Compensates for lost income if cyber incidents halt normal operations.

Not every startup needs the same mix. Your risk profile, client contracts, and target markets all shape which insurance features matter most. A knowledgeable broker can help you build the right blend.

Policy Limits, Sub-Limits, and Exclusions

Photo by Mikhail Nilov

Photo by Mikhail Nilov

Policy limits and sub-limits define the ceiling for payouts from your insurer. It’s not enough to scan for a big dollar amount on the front page—custom coverage means tuning these amounts to your real risks:

- Overall Policy Limit: The maximum total your insurer will pay for all covered losses.

- Sub-Limits: Reduced limits for specific incidents, like ransomware, funds transfer fraud, or legal costs.

- Individual Event Caps: Some policies will pay only a set amount per data breach or regulatory investigation.

Exclusions—sections where your insurer will not cover you—are just as important. Every policy has a list. Common exclusions for cybersecurity startups might include:

- Attacks caused by insider fraud or gross negligence.

- Claims arising from known vulnerabilities left unpatched.

- Certain types of regulatory fines or contract breaches.

To understand how exclusions can affect your protection, review this resource on Understanding Insurance Policy Rights. It explains how policy wording can leave gaps—and what to watch out for before you buy.

Endorsements to Address Advanced Threats

Cyber risks evolve fast, so a custom plan allows you to add endorsements—policy add-ons—to keep up with new exposures. Some examples that matter for cybersecurity ventures:

- Social Engineering Fraud Coverage: Protects if someone in your team is tricked by a phishing scam into sending money or disclosing credentials.

- Reputation Recovery Endorsements: Offers resources for crisis management, public relations, and rebuilding trust after a breach.

- Cryptojacking and Digital Asset Protection: Insures costs related to unauthorized cryptocurrency mining or theft of tokens/data.

- System Failure Extensions: Covers software or hardware outages from non-malicious technical failures, often overlooked in standard cyber policies.

Choosing the right endorsements fine-tunes your policy and plugs gaps that may grow as your business or threat exposure changes. The best insurance advisors continually review your plan, suggesting new options as technology and attacker tactics shift.

When designing a policy, make sure you’re opting for features that not only address your current risks but also give you the flexibility to adjust as your company grows and faces new threats.

Steps to Build a Custom Cyber Insurance Plan

Building a cyber insurance plan that fits your startup is not a one-size-fits-all process. A tailored policy protects you against threats unique to the cybersecurity sector and keeps your business flexible as new risks appear. The steps below guide you through assessing your needs, comparing policies, and keeping coverage current as your company grows.

Conducting a Risk Assessment

Start with a clear-eyed review of your vulnerabilities and digital assets. This step lays the groundwork for the rest of your insurance decisions.

- Identify data and systems at risk. List critical platforms, sensitive databases, and high-value intellectual property.

- Map out potential threats. Include obvious ones like phishing and ransomware, but also factor in supply chain and insider risks.

- Review recent incidents. Look at cyber attacks your company or industry peers faced. This helps honestly gauge your exposure.

Outside experts can spot weak points you might miss. Consider hiring a cybersecurity consultant to lead your risk review. This investment often results in more accurate, efficient insurance planning. Many insurers require a formal assessment and may use it to price your policy.

Focus on capturing details like:

- Where is data stored (cloud, on-premises, hybrid)?

- Who has access to sensitive information?

- What third-party vendors or contractors connect to your systems?

Collect these facts before you start talking to brokers or providers. Solid data leads to better advice and tailored policies.

Comparing Policies and Providers

Once you know your exposures, it’s time to compare insurers and policy options. Coverage varies widely—never assume two “cyber” policies offer the same protection.

Photo by Mikhail Nilov

Photo by Mikhail Nilov

Begin by collecting quotes and copies of policy language from at least three insurers. Pay special attention to:

- Policy limits and sub-limits

- Covered events (ransomware, third-party breaches, regulatory claims, etc.)

- Exclusions (what’s not covered)

- Response and claims support (how fast and effective are their response teams?)

Work with a broker who specializes in tech and cyber risks. They know which companies support startups and can help you understand complex terms. Ask about endorsements—extras like social engineering or regulatory fine coverage that standard policies often lack.

As you weigh options, don’t ignore customer service. Insurer response quality during a claim is as important as coverage details. For more context on how policies can adapt as your business evolves, the resource on Small Business Insurance Strategies 2025 breaks down key steps in updating protections as you grow.

Get all promises and explanations in writing. If policy language is unclear, request plain-language explanations—and keep a copy.

Reviewing and Adjusting Coverage Over Time

A cyber insurance plan is not “set and forget.” New contracts, products, and regulations constantly reshape your risk profile. Build a routine to review coverage at least once a year—or after major milestones like signing a big client or expanding into a new market.

Effective policy reviews include:

- Examining your latest risk assessment.

- Scanning for new types of attacks or regulatory changes.

- Checking if your client contracts now require higher limits or more specific coverages.

Update your insurer with these changes to avoid coverage gaps. If your security posture improves—say, you add encryption or staff training—ask about discounts or lower rates.

Treat your policy as a living document. Adjust limits and add new endorsements as your business plan or threat profile shifts. Strong relationships with an informed broker and insurer make this process much smoother.

Regular reviews keep your insurance in sync with your true risks and growth, so your custom plan keeps working as designed.

Balancing Cost and Coverage for Startups

Cybersecurity startups need to safeguard critical operations without draining their financial lifeline. Every dollar spent on insurance is a dollar not used for product development, hiring, or scaling up. Still, underinsuring puts your business at risk if an attack hits or a liability surfaces. Finding a sweet spot—where you protect what matters most and control your premium costs—keeps your startup agile and safe.

Setting Coverage Priorities

Startups rarely have the luxury to cover every possible risk from day one. Focusing on the essentials ensures your budget delivers maximum value. Begin by protecting functions that could cripple the business if lost and meet any legal or contractual obligations upfront.

Here are practical ways to set priorities:

- Identify core revenue drivers: Which products, services, or client relationships keep the business running? Make sure they’re protected first.

- Check contract requirements: Many clients require specific insurance types or limits. Missing these means lost deals or breached contracts.

- Regulatory must-haves: Compliance gaps trigger fines or investigations. Cover the basics—for example, coverage for privacy breaches—to avoid setbacks.

- Weigh operational disruption: Could an incident take your systems offline or lead to a lawsuit? Focus on coverage that keeps you trading and protects cash flow.

- Review vendor and partner risks: If partners have access to your systems, gaps in their security can cause issues for you. Make sure your policy fills these gaps.

As new projects launch or major deals close, revisit your priority list. Staying nimble with your coverage keeps you protected as your business shifts.

Photo by cottonbro studio

Photo by cottonbro studio

Understanding the Impact of Deductibles and Premiums

Startups aiming to maximize their insurance spend must understand how deductibles and premiums work hand-in-hand. These two elements can make or break your financial plan.

- Deductibles are the amount you pay out of pocket before insurance coverage kicks in. A higher deductible usually means a lower monthly premium, but can strain your cash flow during a claim.

- Premiums are the regular payments you make to keep your policy active. Lowering premiums might help your immediate budget, but too high a deductible can become a problem when a loss occurs.

To find the right balance:

- Establish your cash buffer. Can you manage a higher deductible without putting your business at risk if an incident happens?

- Model common loss scenarios. Factor in how much you’d owe before insurance helps. Is it realistic for your startup’s budget?

- Negotiate flexible payment options. Some insurers let you spread premium costs or adjust deductibles to match seasonal cash flow.

- Check if smaller, frequent claims could hurt your bottom line. You may want a lower deductible for recurring risks, such as phishing losses or small-scale breaches.

Avoid skimping on coverage just to save on premiums. Gaps often cost more when you factor in legal fees, lost business, or damaged reputation. For a more detailed look at how insurance options can match your business needs at each stage, see the guide on insurance strategies for growing businesses.

A sensible blend of deductible and premium lets you stay protected and in control, even as your business shifts and grows.

Conclusion

Custom insurance coverage is not optional for cybersecurity startups—it’s a smart, necessary step to shield your company from unique exposures in a demanding field. A thoughtful plan fills gaps left by basic policies, protects your reputation, and satisfies client and regulatory demands. As your business grows, adjusting your insurance means you stay ready for whatever threats or opportunities appear.

Take time to reassess your current coverage. Work with experts who know your space and rely on resources like those found at Shielded Future to stay ahead of new risks. With the right protection in place, you can keep building your vision with confidence.