From priceless art to rare memorabilia, private museum collections face more threats than ever before. Modern risks—like targeted theft, extreme weather, cyberattacks, and accidental damage—can strike unexpectedly and devastate one-of-a-kind holdings. Owners and curators understand that standard policies don’t always protect the full value or unique nature of these irreplaceable treasures.

Specialized insurance steps in to cover what traditional plans can’t. Whether a collection is displayed in a private gallery or tucked away in a personal archive, the right protection isn’t optional—it’s critical. If you’re interested in how coverage can safeguard fine art and rare collectibles, see our guide on Insurance for High-Value Items.

Understanding the latest threats and knowing what to look for in a private museum insurance policy helps owners stay ahead of loss. In this post, you’ll learn what risks these collections face, why tailored insurance is a must, and how to choose coverage that fits your specific needs.

Understanding Private Museum Insurance

Owning or managing a private museum brings both pride and responsibility. The treasures inside often hold irreplaceable value—historically, culturally, and financially. Yet, standard property coverage was never meant to protect rare, one-of-a-kind collections against today’s advanced threats. Dedicated private museum insurance fills this protection gap and goes beyond regular policies in key ways.

Unique Risks Faced by Private Museums

Private museums face challenges far beyond simple fire or theft. Collections can include art, artifacts, manuscripts, and rare memorabilia—each item with unique needs and vulnerabilities.

- Targeted Theft: Private collections attract sophisticated criminals who know the value and, often, the weak points in display or storage.

- Environmental Damage: Shifts in humidity, temperature, or accidental water events can destroy what no amount of money can replace.

- Transport and Loan Risks: Moving a painting for a temporary exhibit or accepting an outside loan exposes pieces to extra peril.

- Cyber Threats: Hackers may target museums for valuable data or for ransomware, risking physical and digital loss.

Many standard insurance options fail to acknowledge these specialized threats. For more on how modern risks impact collectible assets, explore our section on Comprehensive Specialty Coverage.

Limitations of Standard Property Insurance

At first glance, a standard property insurance policy may appear to cover museum assets. But these plans were designed for buildings, basic equipment, and furniture—not priceless collections.

Key shortcomings include:

- Depreciated or Capped Value: Most policies compensate based on depreciated value. This never matches the true worth of rare or one-off items.

- Exclusion of “Unusual” Risks: Regular plans often exclude mysterious disappearance, breakage, or third-party damage during transport or loan.

- Insufficient Documentation: Many policies require extensive itemization, but lack mechanisms for tracking provenance or fluctuating valuation.

References from industry leaders, like the Cultural Organizations & Museum Insurance Coverage guide, highlight why museums opt for insurance plans intended for their specific situations. Museums frequently need added protections that aren’t included in general insurance, such as coverage for exhibition loans or loss of value due to restoration.

For a deeper look at where standard coverage fails, our Specialty Insurance Guide 2025 discusses when to look beyond regular policies.

What Specialized Policies Cover

Specialized private museum insurance offers benefits designed for the real lives of collectors, curators, and patrons. These features are tailored so that insurance responds to the true threat profile and value of collections.

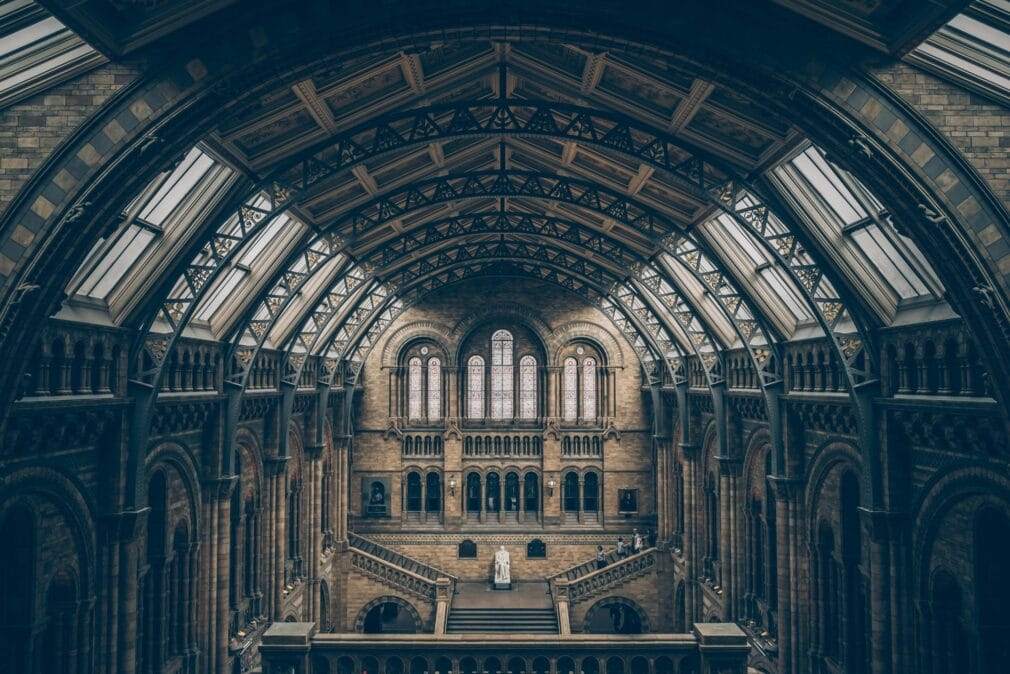

Photo by Joshua

Photo by Joshua

Core features commonly include:

- Agreed Value Coverage: Insurers and owners set an agreed value for each object at the time of policy writing. If there’s a covered loss, you get the full amount—no depreciation, no arguments over replacement cost.

- Provenance Protection: Coverage includes expenses and support for verifying provenance and authenticity, vital if paperwork is lost or questioned after a theft or disaster.

- World-Wide (Global) Coverage: Whether the piece is on display at home, on loan abroad, or in transit, the collection is protected.

- Special Handling Clauses: Some insurers cover damage during installation, restoration, or even temporary display.

- Loss of Value: If an item is restored after partial loss, policies may compensate for the reduction in market value.

These benefits have real impacts. As the American Alliance of Museums’ TechTalk on Collections Insurance outlines, even a seemingly small incident can have outsized financial and emotional costs.

For a full overview of specialty and collection-specific insurance types, including options for art, jewelry, and rare memorabilia, see our Insurance for High-Value Items guide.

Key Modern Threats to Private Collections

Today’s private museums face an expanded list of dangers. Thieves now operate online and on-site. Natural disasters threaten climate-sensitive objects. Even as security systems improve, criminals sharpen their methods. Knowing these threats is the first step to real protection.

The Rise of Cyber Risks in Art Theft

Thieves don’t always need to break a window—sometimes, all they need is a laptop. Cyberattacks have surged across the art and collectibles world. Hackers target digital catalogues, collector databases, and transaction records. With private collections worth millions, museum staff and security partners are increasingly the focus of phishing, ransomware, and sophisticated digital scams.

Cybercriminals have used these tactics to:

- Steal sensitive data that can be sold or used to plan physical thefts.

- Demand ransoms with threats to leak or destroy digitized inventory records.

- Trick curators or owners into wiring payments to false accounts.

According to a recent analysis of industry trends, galleries and private collections report a sharp climb in attempted cyber intrusions. The business of art has a new kind of enemy: the hacker. In fact, as reported by artnet News, nearly 60 percent of galleries surveyed noted an increase in cybercrime targeting their digital assets.

For museums and collectors, this means cyber insurance and advanced cybersecurity measures are now essential—not just smart add-ons.

Climate Events and Disaster Preparedness

Floods, wildfires, and storms hit harder and more often than ever. These disasters damage buildings and the delicate pieces inside. Science-grade climate control and early-warning systems matter, but insurance has evolved too.

Specialty insurance now considers extreme weather not as a rare event, but a likely risk. Insurers use advanced modeling to prepare for what might go wrong. This means private collections get custom coverage for both “traditional” losses (like a water leak) and unexpected ones—such as rapid wildfire evacuations or post-disaster restoration.

Some disaster plans include:

- Mobile response teams for emergency packing and transport.

- Loss-of-income coverage for disrupted museum operations.

- Funds for off-site restoration after smoke, soot, or water exposure.

The insurance market has responded by expanding specialty coverage to meet these needs. You can read about the growth of specialty insurance and how it adapts policy terms to modern disaster patterns. For added context on what events are included, review this overview of natural disaster protection programs.

Advanced Security vs. Evolving Physical Threats

Security tech grows more advanced every year: biometric locks, 24/7 video monitoring, smart sensors, and reinforced display cases. But physical threats also keep changing. Thieves learn how to fool sensors, exploit insider knowledge, and evade staff by blending in during museum events.

New forms of vandalism—including destructive activism—also threaten unique artifacts. Sometimes, loss comes not from outside but from insiders: studies reveal a high percentage of art thefts involve someone linked to the collection. This means background checks and operational protocols remain as important as any device.

To keep ahead, top private museums blend technology and practice:

- Regularly update and test alarm and surveillance systems.

- Limit access to sensitive areas and archives.

- Use layered security, combining old-fashioned vigilance with new tech.

No system is foolproof, but thoughtful planning reduces both risk and loss. For an expanded look at how insurance covers these threats and more, our section on comprehensive specialty coverage for unique risks dives deeper into practical solutions.

Photo by Kaboompics.com

Photo by Kaboompics.com

Selecting the Right Coverage for Irreplaceable Collections

Choosing coverage for private museum collections isn’t about simple replacement. It’s about understanding risk, valuing what can’t be replaced, and making sure insurance solutions match your collection’s unique qualities. Let’s break down how to approach these decisions so your collection gets the protection it truly needs.

Risk Assessment and Appraisal Best Practices

Start by mapping out every threat your collection faces. Not all collections are the same—some live in high-trafficked galleries, others spend time in climate-controlled archives, and some travel for loaned exhibitions. Pinpointing each item’s risk is essential.

Best practices include:

- Inventory & Documentation: Keep an updated inventory with high-res photos, receipts, and proofs of authenticity for every item.

- Professional Appraisal: Use a certified appraiser who specializes in your type of collection. Update appraisals every few years so values stay accurate.

- Environment & Security Check: Review your building’s climate control, security systems, and emergency plans. Address any gaps right away.

- Review Loan & Transit Risks: Document when, where, and how items are moved or displayed outside your site.

Bringing in experts helps prevent loss and positions you to support any future claims. Don’t let outdated appraisals or missing documentation stand between you and a fully-backed policy.

Customizing Policies to Fit Unique Collections

Every collection deserves a policy built to its needs. Off-the-shelf coverage fails when it doesn’t address the detailed value or traits of high-value items. Tailoring policies ensures rare art, antiques, rare books, and memorabilia are individually recognized and covered.

Here are steps for maximizing fit:

- Schedule Items Separately: Work with your insurer to “schedule” or individually list valuable pieces. That way, each item receives its own coverage terms based on documented appraised value.

- Add Specialized Coverage: Seek out policies that include protection for restoration costs, provenance verification, and value lost due to damage—even after repair.

- Adjust for Changing Inventory: Collections grow and change. Make your insurance plans as adaptable as your holdings.

Explore more about tailored policies for specialty collections in our Specialty Insurance Complete Guide 2025.

Importance of Specialty Insurance Riders

Base policies rarely cover every risk. This is where specialty insurance riders—also known as endorsements—make a major difference for private museums. Riders are add-ons that close gaps and address scenarios not included in standard coverage.

For private museums, consider these key rider options:

- Scheduled Property Riders: These let you list valuables on your policy with specific agreed values and protection from unique hazards.

- Transit and Loan Riders: Coverage for items while they’re on loan or being transported—a window when many losses happen.

- Restoration & Diminished Value Riders: Offers extra coverage if expert repair leads to reduced market value.

Skilled insurers will highlight where your risks lie and which rider add-ons bring true peace of mind. For a clear breakdown of how and why to use these add-ons, see our Home insurance riders overview and this guide to Business insurance riders.

Photo by Mikhail Nilov

Photo by Mikhail Nilov

Review these options with an agent who knows the world of high-value assets. When every piece in your collection has a story, the details of your insurance should protect every chapter.

Managing Claims and Loss Recovery

Even the best-protected private museums face moments when disaster strikes or loss occurs. The claims and recovery process can be overwhelming. Acting quickly and following clear steps will help collections owners, curators, and staff get the best outcome. Here’s what to expect when navigating claims and restoring unique pieces.

Documenting Provenance and Condition

Successful claims start long before loss happens. Detailed records—photos, receipts, appraisals, and provenance documents—are your foundation. Insurers rely on proof of ownership, value, and prior condition to process any claim.

- Keep a digital inventory with clear, dated images of each item.

- Store authenticity and provenance paperwork separately, with digital backups.

- Log any previous repairs or restoration details.

- Update documents and images after each exhibition, transit, or loan.

Review your records at least once a year and after significant acquisitions. Some insurers provide guidance or templates for documentation. For more on how comprehensive records support both insurance and the security of a collection, see this advice from museum insurance specialists.

Working with Adjusters and Experts

The claims process can feel technical, but good communication is key. After reporting damage or loss, a dedicated adjuster or claims manager will typically visit your museum. They will assess the situation and review your records. When collections involve rare or valuable items, experienced adjusters often consult with:

- Professional art appraisers

- Conservators or restoration experts

- Curators familiar with the collection type

Sharing thorough condition reports and provenance paperwork makes this process smoother. It’s normal for adjusters to request updates or extra documentation, especially for one-of-a-kind pieces. If your policy includes access to expert networks, use this support. Insurers with dedicated art and collection teams—such as those highlighted by PURE Art Insurance Services—ensure your claim is reviewed by professionals with relevant expertise.

- Stay in touch with your claims manager throughout.

- Ask for timeline estimates and updates.

- If items are on loan, alert the lending institution and review any shared responsibilities for coverage.

For claims that require detailed investigation, specialized firms like Raphael & Associates offer in-depth management and can help liaise with conservation teams, especially for complex losses.

Recovery and Restoration Services

After a covered loss, recovery goes beyond financial reimbursement. Prompt, expert preservation work is critical to minimize permanent damage. Insurers often have preferred restoration partners with experience in fine art and specialty items.

Services may include:

- Emergency stabilization and climate control

- Cleaning and repairs by trained conservators

- Detailed documentation of restoration work

- Advice on how repairs may impact the item’s market value

Fast response is essential—water-damaged documents, for example, must receive prompt treatment to prevent mold or decay. Fine art and collectibles restoration specialists like Prism Specialties and Steamatic can often handle everything from sculpture and painting conservation to document recovery.

Whenever possible, restoration should be coordinated with your insurer. This ensures reimbursed costs and that the right standards are met. If items lose value even after expert repair, many specialty insurance policies will also pay for “diminished value.” For collecting institutions that want peace of mind throughout the process, understanding all restoration and loss recovery options is part of effective risk management.

For more strategies specific to rare or high-value property, including claims advice and examples, check out our article on comprehensive specialty insurance for unique risks.

Conclusion

Protecting private museum collections demands more than a basic insurance policy. Owners who take time to document, appraise, and customize their protection are better prepared for modern risks—from cybercrime to severe weather and evolving physical threats. Comprehensive specialty insurance, combined with careful planning and updates as collections grow, guards both the value and the history of each piece.

Smart coverage reviews should happen regularly. If you haven’t revisited your plan lately, now is the time to make sure you’re not leaving gaps. For anyone interested in how these policies are evolving and new types of protection available for high-value collections, see our overview of Art and collectibles insurance trends.

Private museum insurance is more than a safety net—it’s an act of stewardship. Every step you take shored up by the right coverage keeps rare and remarkable collections safe for generations to come. Thank you for reading—your commitment to protection is what keeps history alive.