Automobile insurance can be both beneficial and burdensome. It offers protection but comes with costs.

Understanding the pros and cons of having automobile insurance is essential. It helps you make informed decisions about your coverage. On the plus side, insurance provides financial protection in case of accidents or theft. It can cover repair costs, medical bills, and legal fees.

On the downside, premiums can be expensive, and not all damages may be covered. Balancing these factors is key to finding the right policy. This blog will explore how automobile insurance works. We will discuss its benefits and drawbacks. By the end, you’ll know if it’s worth it for you.

Benefits Of Automobile Insurance

Automobile insurance is more than a legal requirement. It offers several benefits that can save you from financial hardship. Whether you drive daily or occasionally, having coverage can provide peace of mind and protect you from unforeseen expenses.

Financial Protection

Car accidents can be costly. Automobile insurance helps cover the expenses. It can pay for repairs, medical bills, and even legal fees. Without insurance, you might have to pay these costs out of pocket, which can be overwhelming.

- Covers repair costs: If your car is damaged, insurance can help pay for repairs.

- Medical expenses: Insurance can cover hospital bills and treatment costs.

- Legal fees: If you are sued, insurance can help with legal costs.

Legal Requirements

Most places require drivers to have automobile insurance. Driving without insurance can lead to fines or even jail time. Meeting legal requirements ensures you avoid these penalties.

| Country | Minimum Insurance Required |

|---|---|

| United States | Liability insurance |

| Canada | Liability insurance |

| United Kingdom | Third-party insurance |

By having the required insurance, you comply with the law. This can save you from legal trouble and fines. Stay protected and drive with confidence.

Credit: www.insurancebusinessmag.com

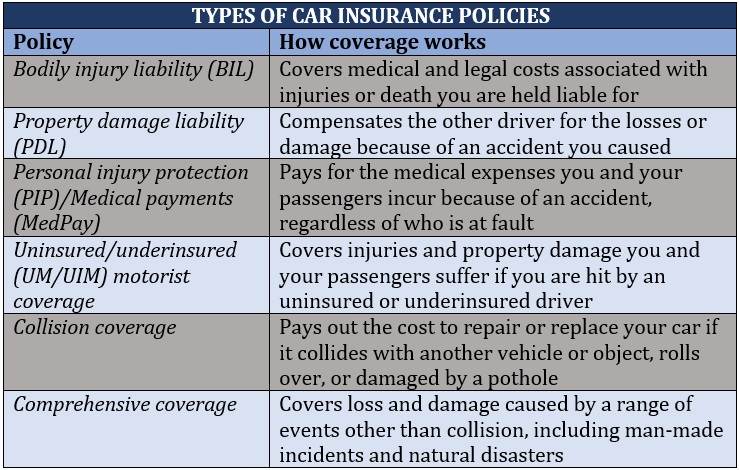

Types Of Coverage

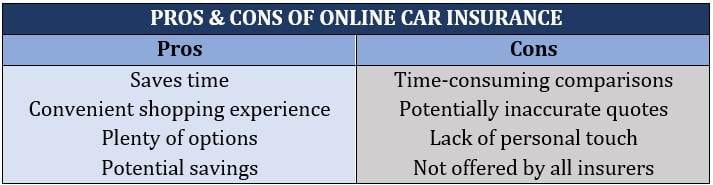

Automobile insurance offers various types of coverage to meet different needs. Each type of coverage provides specific protections and can help in different situations. Understanding these types can help you make informed decisions.

Liability Coverage

Liability coverage is one of the most important types of car insurance. It covers expenses if you cause an accident and damage someone else’s property or injure them. This coverage helps protect you from financial loss due to lawsuits. In many places, liability coverage is required by law.

Collision Coverage

Collision coverage pays for damage to your car from an accident. Whether you hit another vehicle or an object, collision coverage can help. This type of coverage is especially useful for newer or more expensive cars. It ensures you can repair or replace your vehicle after an accident.

| Type of Coverage | Description |

|---|---|

| Liability Coverage | Pays for damages and injuries you cause to others. |

| Collision Coverage | Covers damage to your vehicle from an accident. |

These types of coverage each offer unique benefits. By understanding them, you can choose the right insurance for your needs and stay protected on the road.

Cost Factors

Having automobile insurance is essential for many drivers. It offers financial protection in case of accidents, theft, or damage. Yet, the cost of automobile insurance can vary. Let’s explore the cost factors that impact your insurance premium.

Premium Rates

The premium rate is the amount you pay for your insurance policy. Various factors influence this rate:

- Age: Younger drivers often pay higher premiums due to inexperience.

- Driving Record: A clean driving record can lower your premium.

- Car Make and Model: Expensive or high-performance cars usually have higher premiums.

- Location: Urban areas with higher accident rates can increase premiums.

- Coverage Level: More comprehensive coverage costs more.

Deductibles

The deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but it means you pay more in case of a claim. Here’s how it works:

| Deductible | Monthly Premium |

|---|---|

| $500 | $100 |

| $1,000 | $80 |

| $1,500 | $60 |

Choosing the right deductible is a balance. A higher deductible means lower monthly costs but higher out-of-pocket expenses during a claim.

Consider your financial situation. Choose a deductible you can afford in an emergency. This balance can help manage your overall insurance costs effectively.

Credit: criminallawyerslasvegas.com

Claims Process

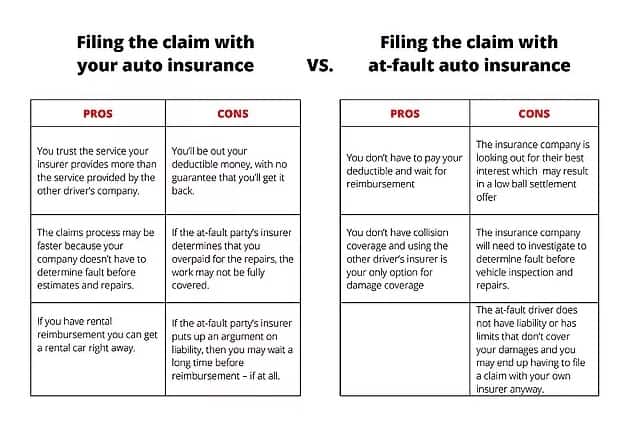

The claims process is a crucial aspect of automobile insurance. It determines how quickly and efficiently you receive compensation after an accident or damage. Understanding this process can help you make informed decisions about your insurance needs. Let’s break down the key elements of the claims process.

Filing A Claim

Filing a claim is the first step in the claims process. This involves notifying your insurance company about the incident. You will need to provide details such as:

- Date and time of the incident

- Location of the accident or damage

- Descriptions of the vehicles involved

- Contact information of any witnesses

- Police report, if applicable

Most insurance companies offer multiple ways to file a claim. You can do it online, over the phone, or through a mobile app. The process is usually straightforward and designed to be user-friendly.

Settlement Time

The settlement time refers to how long it takes for the insurance company to process your claim and issue payment. This time frame can vary based on several factors, including:

- The complexity of the claim

- Availability of required documentation

- Speed of communication between all parties involved

On average, simple claims may be settled within a few weeks. More complex claims can take several months. Promptly providing all necessary information can help speed up the process. Regularly following up with your insurance company can also keep your claim moving forward.

Knowing what to expect from the claims process can make it less stressful. It can ensure you get the compensation you need in a timely manner.

Discount Opportunities

Automobile insurance provides more than just financial protection. It offers various discount opportunities that can help reduce your premium. Understanding these discounts can save you a significant amount of money. Here are some key discount opportunities you can leverage.

Safe Driver Discounts

Insurance companies reward safe drivers. If you maintain a clean driving record, you can qualify for a safe driver discount. This means no accidents or traffic violations. Safe driving behavior can lower your insurance costs.

- No traffic tickets

- No at-fault accidents

- Completion of defensive driving courses

Bundling Policies

Bundling your insurance policies with one provider can lead to significant savings. This means combining your auto insurance with other types of insurance, like home or renters insurance. Many companies offer multi-policy discounts.

| Policy Type | Potential Discount |

|---|---|

| Auto + Home | Up to 25% |

| Auto + Renters | Up to 15% |

| Auto + Life | Up to 10% |

Bundling policies can simplify your insurance management. You deal with one company and receive one bill. It makes life easier and can save you money.

Potential Drawbacks

While automobile insurance provides peace of mind and financial protection, it has its downsides. Here, we discuss some potential drawbacks of having automobile insurance.

High Premiums

One major drawback of automobile insurance is the high premiums. Insurance companies calculate premiums based on various factors:

- Driver’s age and driving history

- Type and age of the vehicle

- Location and usage

Young drivers or those with a poor driving history often face higher premiums. This can be a significant expense, especially for those on a tight budget.

Coverage Limitations

Another drawback is coverage limitations. Not all damages or incidents are covered by standard policies. For example:

- Natural disasters

- Acts of vandalism

- Wear and tear

To cover these exclusions, additional coverage or riders are necessary, which increases costs. This can leave some drivers feeling inadequately protected despite paying high premiums.

Impact On Driving Behavior

Automobile insurance can greatly influence how people drive. It can either encourage safer driving or lead to risky behavior. The impact on driving behavior is significant and worth understanding.

Risk-taking Reduction

Insurance policies often come with incentives for safe driving. These include lower premiums and no-claim bonuses. Drivers are encouraged to avoid accidents to save money. This leads to more cautious driving.

Here are some ways insurance reduces risk-taking:

- Financial Incentives: Lower costs for accident-free records.

- Penalties: Higher premiums for risky behavior.

- Monitoring: Usage-based insurance tracks driving habits.

Safe driving is rewarded. Risky driving is penalized.

Overconfidence Risks

On the other hand, having insurance may make some drivers overconfident. They may feel protected and take unnecessary risks. This false sense of security can lead to accidents.

Consider the following:

- False Security: Belief that insurance will cover all damages.

- Carelessness: Reduced attention to road safety.

- Increased Speeding: Less fear of financial consequences.

Insurance can create a safety net. But it should not replace responsible driving.

In short, while automobile insurance promotes safer driving, it can also lead to overconfidence. Balancing these effects is key to better driving behavior.

Credit: www.insurancebusinessmag.com

Choosing The Right Policy

Choosing the right automobile insurance policy can be a daunting task. With so many options available, it’s important to find the policy that best suits your needs. This section will guide you through the process of selecting the right policy for you. We’ll break it down into two key areas: Assessing Needs and Comparing Providers.

Assessing Needs

Start by evaluating what you need from your automobile insurance. Consider the following factors:

- Vehicle Type: The make, model, and age of your vehicle can affect your coverage needs.

- Driving Habits: How often and where you drive can influence the type of coverage you require.

- Budget: Determine how much you can afford to pay for premiums and deductibles.

- Legal Requirements: Each state has different minimum coverage requirements.

- Personal Preferences: Some people prefer more comprehensive coverage for peace of mind.

By understanding your needs, you can narrow down your options and choose a policy that offers the best protection.

Comparing Providers

Once you know what you need, it’s time to compare insurance providers. Here are some tips for finding the best provider:

- Research: Look for reviews and ratings of different insurance companies.

- Coverage Options: Ensure the provider offers the types of coverage you need.

- Discounts: Check if the provider offers discounts for safe driving, bundling policies, or other factors.

- Customer Service: Good customer service can make a big difference when filing a claim.

- Financial Stability: Choose a provider with a strong financial rating to ensure they can pay claims.

Use these criteria to compare providers and find the best match for your needs. Remember, the cheapest option isn’t always the best. Look for a balance of cost, coverage, and service quality.

Frequently Asked Questions

What Are The Benefits Of Automobile Insurance?

Automobile insurance provides financial protection in case of accidents or theft. It covers repair costs and medical expenses. Additionally, it offers peace of mind while driving.

Are There Any Drawbacks To Automobile Insurance?

Yes, automobile insurance can be expensive. Premiums may increase after claims. Also, not all damages might be covered, leading to out-of-pocket expenses.

How Does Automobile Insurance Help In Accidents?

Automobile insurance covers repair costs and medical bills after an accident. It reduces financial burden and ensures timely assistance. This can be crucial in emergencies.

Is Automobile Insurance Legally Required?

Yes, automobile insurance is mandatory in most places. It ensures that drivers can cover damages or injuries they cause. Without it, you may face legal penalties.

Conclusion

Having automobile insurance offers many benefits but comes with some drawbacks. It provides financial protection in accidents. Peace of mind is another key advantage. On the downside, insurance premiums can be costly. Some policies may have complicated terms. Weigh the pros and cons carefully.

Choose the best option for your needs. In the end, having insurance can save you from big expenses. It ensures you drive with confidence. Make an informed decision to protect yourself and your vehicle.

Speaking of automobile insurance, you might be interested in exploring more about the importance of auto insurance and how it varies across different regions. Additionally, understanding the concept of defensive driving can offer insights into how safe driving practices can lower your insurance costs. If you’re curious about the legal aspects, check out the article on insurance regulation to learn why automobile insurance is mandatory in most places!